It's no secret that homeownership comes with many undeniable perks. However, the "American Dream" also comes with its fair share of unexpected problems (and costs) - many of which you can't see. And if there's one thing most homeowners can mutually agree on, it's that out of sight should not mean out of mind when it comes to property maintenance. After all, some of the costliest potential home repairs lie buried below the surface. We're talking about your home's service lines.

It's no secret that homeownership comes with many undeniable perks. However, the "American Dream" also comes with its fair share of unexpected problems (and costs) - many of which you can't see. And if there's one thing most homeowners can mutually agree on, it's that out of sight should not mean out of mind when it comes to property maintenance. After all, some of the costliest potential home repairs lie buried below the surface. We're talking about your home's service lines.

Many homeowners are surprised to learn that the repair or replacement of service lines on their property is actually their responsibility, not the service provider's or the City's. Most of the time, service line failures happen unexpectedly and cost around $6,000 on average to repair - ouch! Luckily, you can avoid the financial burden of paying for surprise service line repairs out of pocket by adding Service Line Coverage to your CNI Homeowners policy. Let's dig (pun intended) right in to why you should have this beneficial coverage for your property and how a hundred bucks can buy you some major peace of mind.

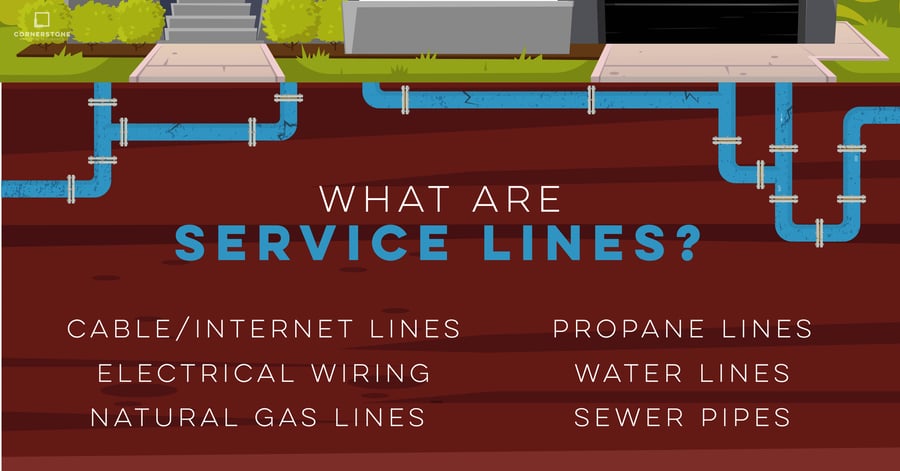

Understanding Service Lines: What Are They & How Do They Become Damaged?

Service lines are a series of underground piping or wiring that connects your home to a public utility service provider or to a private system.

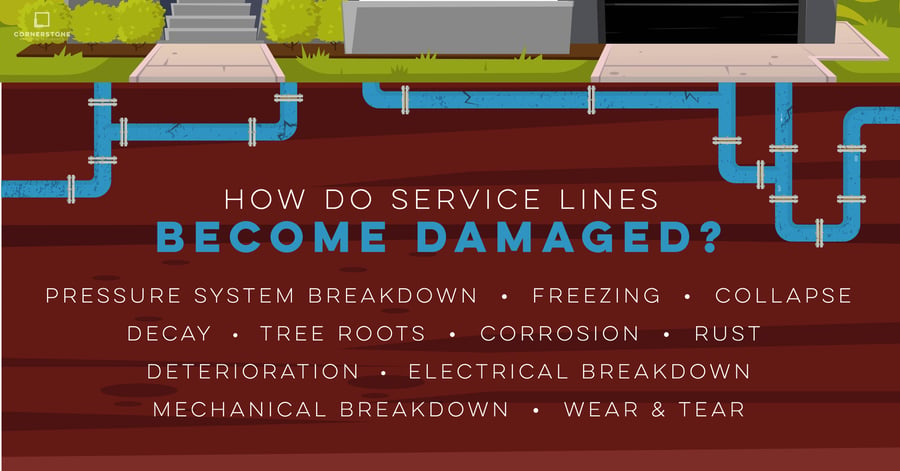

Service lines can become physically damaged by a number of natural causes.

What Is Service Line Coverage?

CNI proudly partners with loss control company, Mutual Boiler Re, to offer our policyholders coverage for their property's underground service lines. This exclusive coverage provides protection from an unexpected loss caused by any number of the service line failure examples listed above, up to the amount of $10,000 with a low $500 deductible. When a homeowner with this product experiences damage to a service line, the coverage may step in and take care of:

- Costs required to repair or replace the damaged covered service line as a result of a service line failure.

- Outdoor property that is damaged as a result of a service line failure or damaged during the excavation of a covered service line following a service line failure.

- Extra costs to make temporary repairs, expedite permanent repairs or permanent replacements to a service line that is damaged as a result of a service line failure.

- Damage to wiring used for communication or data transmission.

- Additional Living Expenses (ALE) accrued from being temporarily displaced from your residence as a result of a covered service line failure.

The main thing not covered by this product is blockage, as this occurrence is not considered direct physical damage to a line or pipe.

Do You Have Service Line Coverage?

As mentioned earlier, service line coverage is not included in a standard CNI Homeowners policy, but can be added as an endorsement. In order to have access to this beneficial protection, you must request that this coverage be added to your policy.

The best part about this product is that it's only $100 a year in premium for CNI policyholders, and comes with Equipment Breakdown protection as well. That's right - $100 a year now to cover a potential $6,000 claim down the road.

To give you a clearer picture of when you might be extremely thankful for this coverage, consider these service line loss scenarios.

A tree root grew through a sewer pipe located on your home's premises causing it to leak. The sewer line was 200’ long and required a backhoe to dig up the damaged piping and replace it.

Estimated Property Damage: $5,800

An underground power line providing electrical service to your home significantly deteriorated over time and resulted in arcing. The underground power line had to be excavated and replaced due to extensive damage discovered during the repair work.

Estimated Property Damage: $7,800

Your water main starts to leak underground. The leaking water then flows out of the area where the pipe is broken and starts to erode the surrounding soil. In a matter of weeks, the erosion is apparent above ground level, creating a sinkhole on your property.

Estimated Property Damage: $10,000

Unbeknownst to you, your older home's original water lines have slowly corroded over time and started to leak in several locations. Eventually, a pipe bursted, causing visible water damage near your home's foundation. After inspection, you're told the water lines require complete excavation and replacement.

Estimated Property Damage: $4,000

Did you know the average age of underground pipes throughout the country is 75? However, the average lifespan of a water main or sewer line is only 65. If your home's service lines are close to (or past) retirement age, you may want to add Service Line Coverage to your CNI Homeowners policy.

Need more convincing about just how beneficial the addition of Service Line Coverage could be to your homeowners policy? Take a look at this testimonial.

After helping one of her clients avoid a $6,000 out-of-pocket bill on service line repairs, one of our trusted CNI Agents, will always urge homeowners to add Service Line Coverage to their CNI policy. An added bonus? It's only $40 extra, annually.

Quote Continued: "In my opinion, Service Line Coverage is one of the best additions to a CNI policy. This coverage can give a homeowner some peace of mind for those unexpected problems at an extremely inexpensive cost."

While nothing can ever fully prepare you for the maintenance costs associated with homeownership, the confidence you'll feel from knowing you have a solid insurance policy backing you up in the event of a potentially pricey disaster is extremely comforting. For more details on how to add this beneficial coverage to your policy, contact a trusted CNI agent today.

While nothing can ever fully prepare you for the maintenance costs associated with homeownership, the confidence you'll feel from knowing you have a solid insurance policy backing you up in the event of a potentially pricey disaster is extremely comforting. For more details on how to add this beneficial coverage to your policy, contact a trusted CNI agent today.

*CNI currently offers Homeowners insurance in our Oklahoma, Arkansas, Illinois, and Tennessee markets. Those states are eligible for Service Line Coverage.